Even to this day, ambulance billing and reimbursement is not a simple and straightforward process.

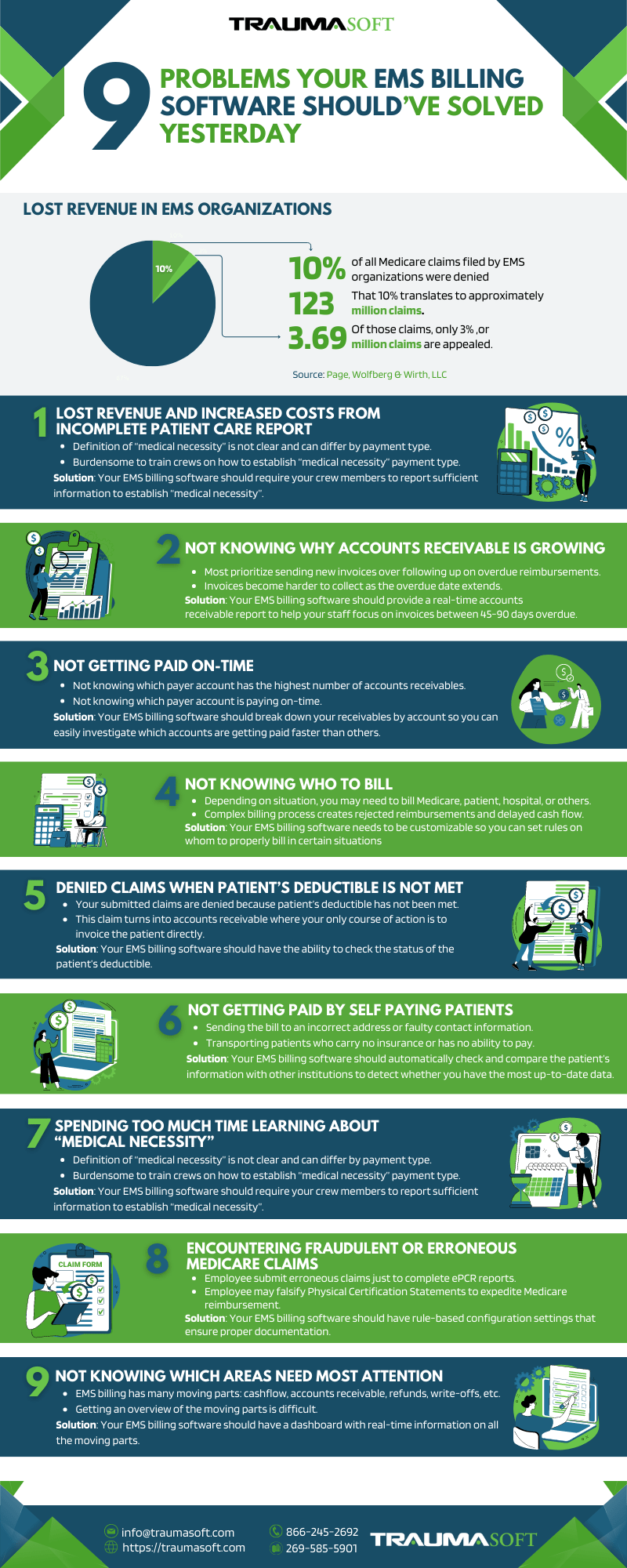

The latest data provided by Page, Wolfberg & Wirth, LLC, using Medicare data provided by Center for Medicare & Medicaid Services (CMS), shows that a full 10% of all Medicare claims filed by EMS organizations were denied. That 10% translates to approximately 123 million claims. Of those claims, 3% are appealed. The appeal process takes years to resolve and will face further delay as additional appeals pile in.

The referenced data dates back to 2015, but we think the picture is very similar today.

In a simple world, patients would pay for emergency medical services soon after they receive their service bill. Unfortunately, that is not the case, and why EMS billing continues to be a painful process to this day.

In this article (and infographic below), we’ve outlined billing challenges, and how a robust EMS Billing Software should alleviate you of those problems. The infographic summarizes the problems and solutions, and the article below provides more details about the problems and solutions.

1. Lost Revenue and Increased Costs from Incomplete Patient Care Report

When a claim with incomplete information is submitted for reimbursement, it gets rejected. Worse, improperly billed claims can lead to burdensome audits where you lose valuable man hours cooperating with authorities. This is not to mention the anxiety and uncertainty audits can trigger in your employees.

Billing staff relies heavily on your crew’s documentation. When the billing department finds the billing data incomplete, they have to chase down the crew personnel who filled out the patient care report. If the crew member doesn’t remember the exact patient information, more hours need to be spent chasing that information.

Because this process can be so onerous, claims with incomplete information often go unfinished. Your billing team moves on to processing new claims, and the denied or incomplete claims often sit and go unreimbursed.

Your billing software should have an automated way to ensure that the patient care report is complete so it can be properly billed. This will force the crew member to obtain the necessary information when they are best equipped to do so – when they are at the scene of picking up the patient. There, they can work to obtain this information from the patient, facility rep, or family or friends at the scene. Not only will this avoid delays, the billing process will go through seamlessly, and invoices will go out faster.

The challenge, however, is that this automation rule requires your ePCR software to integrate seamlessly with your billing software. Here at Traumasfot, we solve that problem by offering both ePCR and billing in one complete software management system.

2. Not Knowing Why Accounts Receivable is Growing

Because of limited staff and resources, most EMS providers prioritize sending out invoices over following up on overdue reimbursements. We get it. EMS companies are not collection agencies. But if this responsibility is not taken seriously, it could lead to devastating cashflow problems.

To solve this problem, the EMS billing software should provide a real-time accounts receivable report that details the (1) total amount of accounts receivable outstanding, (2) how many days outstanding, and (3) on what accounts.

When comparing account receivable reports by periods, you can find answers to these questions:

- Is the overall accounts receivable growing?

- Which accounts have the highest balance of receivables?

- What amount of receivables are 90 days overdue and in what accounts?

As best practice, since your invoices typically get paid in 30-45 days, your staff should focus on collecting those that are between 45-90 overdue. They should put less effort on those that are 90 days overdue since it’s much more difficult to get those paid.

3. Not Getting Paid On-Time

The issue here is similar to overall accounts receivable measurement in #2. The key here is to report on who your primary payers are and whether they’re paying on time.

When you break down your receivables by account, you can investigate why certain accounts are getting paid faster than others. Industry expert Anthony Minge, EdD, Fitch & Associates, stated that Medicare is “one of the fastest in the industry to process claims”, and that “Your primary Medicare payor bucket should not have large balances aged out.” If your reports show that Medicare is slow to pay, you know where to start your analysis. Sometimes a simple fix, like finishing incomplete ePCR’s, can make a dramatic difference.

4. Not Knowing Who to Bill

Should you bill Medicare when you transport a Medicare beneficiary? Not necessarily.

Depending on the situation, you may need to bill the patient, the facility (that’s getting per diem from the Federal Government), or the hospital. Or, if you’re transporting a hospice patient, you may want to bill the hospice instead. The billing process also gets complex when you’re billing a Skilled Nursing Facility (SNF). Generally, a transport of SNF resident in a Part A stay is billable to the SNF, not Medicare Part B, but there are exceptions.

The key is to determine whom you should bill. Your EMS billing software needs to be customizable so you can set rules on whom to properly bill in certain situations and get reimbursed in a timely fashion.

5. Denied Claims When Patient’s Deductible is Not Met

A common occurrence for EMS providers, especially in the first half of the calendar year, is to have claims denied when patient’s deductible is not met. After transporting a patient, you promptly invoice that patient’s insurance company. Later, you’re notified that your claim is denied because the patient’s deductible has not been met. This quickly turns into an accounts receivable problem where your only course of action is to invoice the patient directly and hope you receive payment or partial payment eventually.

To resolve this problem, your EMS billing software should have the ability to check the status of the patient’s deductible. This way, you have the choice to hang on to a patient’s invoice and send it to the insurance company after the patient’s deductible has been met. If you can wait for payment, your chances of full reimbursement increase significantly. Again, this requires that your EMS billing software be customizable.

6. Not Getting Paid by Self-Paying Patients

Some problems that EMS organizations encounter when billing self-paying patients are:

- Not sending the bill to the correct address

- Sending a bill to someone who has no ability to pay

- Transporting patients who carry no insurance

Any of the above situations can turn your invoice into another accounts receivable problem. Moreover, for points two and three, you may not get reimbursed even if you have the resources to follow-up on those receivables.

To avoid these problems, your EMS billing software should automatically check and compare the patient’s information with other institutions to detect whether you have the most up-to-date data. These include checking the patient’s information with various insurance providers and credit agencies to determine their credit worthiness. Your software needs to be customizable so there’s a protocol in place for scheduling a trip for patients with no credit worthiness and/or questionable credit worthiness.

7. Spending Too Much Time Learning about “Medical Necessity”

The rules and regulations that govern this industry are confusing and sometimes contradictory. For instance, to be eligible for reimbursement, ambulance transports must be “medically necessary”. However, the definition of medical necessity is not clear cut. Additionally, this definition can differ by payment type, including commercial, Medicare and Medicaid. It can be burdensome to train your crews on how to establish “medical necessity” per payment type when completing a patient care report.

Instead, the preferred alternative is to simply require your crew members to report sufficient information. That means that your ePCR software and EMS billing software should be integrated seamlessly so you can have a customizable, rule-based standard to avoid inconsistent or incomplete patient records (similar to #1). The more complete the information, the easier it is for “medical necessity” to be established. This way, you will avoid the most common way reimbursements are denied.

8. Encountering Fraudulent or Erroneous Medicare Claims

People sometimes turn to desperate measures when they’re under financial pressure. That’s what we think happened when an EMS employee in Rutherford County falsified Physical Certification Statements to expedite Medicare reimbursement. The county was required to pay back $400,000 to $700,000 to the U.S. Department of Health and Human Services. Similarly, in 2011, the City of Dallas had to pay $2.47 million after a whistleblower reported that all medical transports were being billed as ALS. Losing that amount of cash could be devastating for EMS organizations of any size.

To avoid fraudulent or erroneous claims, your EMS billing software should have rule-based configuration settings that ensure proper documentation like patient signatures and Physical Certification Statements be provided before invoices are generated. For added protection, you should also implement a process where you periodically review a random sample of claims.

9. Not Knowing Which Areas Need Most Attention

There are many moving parts when it comes to EMS billing – cashflow, accounts receivable, refunds, write-offs, revenue adjustments, etc. In most billing systems, your staff can’t get an overview of the cashflow until month’s end (or until the period is closed out).

What is needed is real-time information on all EMS billing’s moving parts. The information should provide answers to questions like:

- Total amount in accounts receivable and how they compare with previous periods

- Real-time cashflow and expected cashflow by end of period

This information is especially critical for EMS providers with limited funds and staff because it helps them prioritize the most important tasks to maximize the timing and magnitude of cash inflows.

Conclusion

EMS companies are tasked to save lives, not operate as collection agencies. If, however, providers cannot get reimbursed for their services, their ability to save lives is negatively impacted. Most providers require a steady stream of revenue to continue operations. A comprehensive and highly customizable EMS billing software can help achieve just that.

If you are experiencing any of these issues, schedule a 30-minute demo with Traumasoft to see how we can help.

What other Billing and collections problems are you experiencing? Contact us now to see whether we can help you solve those problems!